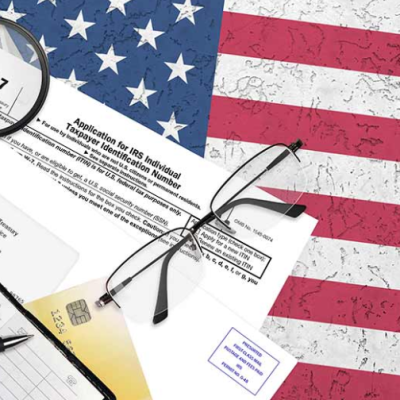

The United States offers a wealth of opportunities for entrepreneurs, investors, and businesses worldwide. However, non-U.S. residents looking to operate or invest in the U.S. must navigate the tax and regulatory environment carefully. Two key identifiers, the Employer Identification Number (EIN) and the Individual Taxpayer Identification Number...